Disclosure Policy

1.Basic Disclosure Policy

The Company recognizes that fair and impartial information disclosure to our shareholders and other

stakeholders, as well as ongoing dialogues, are essential in achieving sustainable growth and

raising corporate value over the medium and long term.

Based on this recognition, we disclose

information in accordance with relevant laws and regulations, such as the Financial Instruments and

Exchange Act, and the timely disclosure rules stipulated by the Financial Instruments and Exchange.

Even information that does not fall under these laws and regulations, we endeavor to disclose

information that we believe is necessary for the investment decisions of our shareholders and

investors in a prompt and fair manner.

Through the timely and appropriate disclosure of

information and constructive dialogue with all of our stakeholders, we will build a good

relationship of trust with the capital markets. At the same time, we will provide appropriate

feedback on market opinions and evaluations to our management. In this way, we will achieve

sustainable growth and increase corporate value over the medium to long term.

2.Information Disclosure Methods

- (1)Timely Information Disclosure

-

-

Timely disclosure of important information

With regard to important information concerning the company operations, management, financial results, etc., must be disclosed according to the timely disclosure rules stipulated by financial instruments exchanges, as this information has a significant impact on securities investment decisions (e.g., information regarding decisions made by a publicly traded company and subsidiaries, information regarding factual events, information regarding financial results, etc.). We carry out disclosure procedures for this information in accordance with the rules stipulated by the finance instruments exchanges. As necessary, we also publish information on our corporate website and through external media channels.

Important information is disclosed by the Division Manager of the Corporate Planning Division under the direction of Director (CFO, director in charge of disclosure) after being approved by the Board of Directors according to the content of such information. -

Disclosure of Voluntary Information

We will actively disclose information that does not fall under the above-mentioned timely disclosure rules, as well as information that we judge to be useful information that contributes to investment decisions, while considering timeliness and fairness.

-

Timely disclosure of important information

- (2)Method of information disclosure

- Important information stipulated in the timely disclosure rules, as well as useful voluntary information that does not fall under these rules, will be disclosed through TDnet, a timely disclosure information transmission system ("TDnet") provided by the Tokyo Stock Exchange. At the same time, this information will also be posted on IR section of our website.

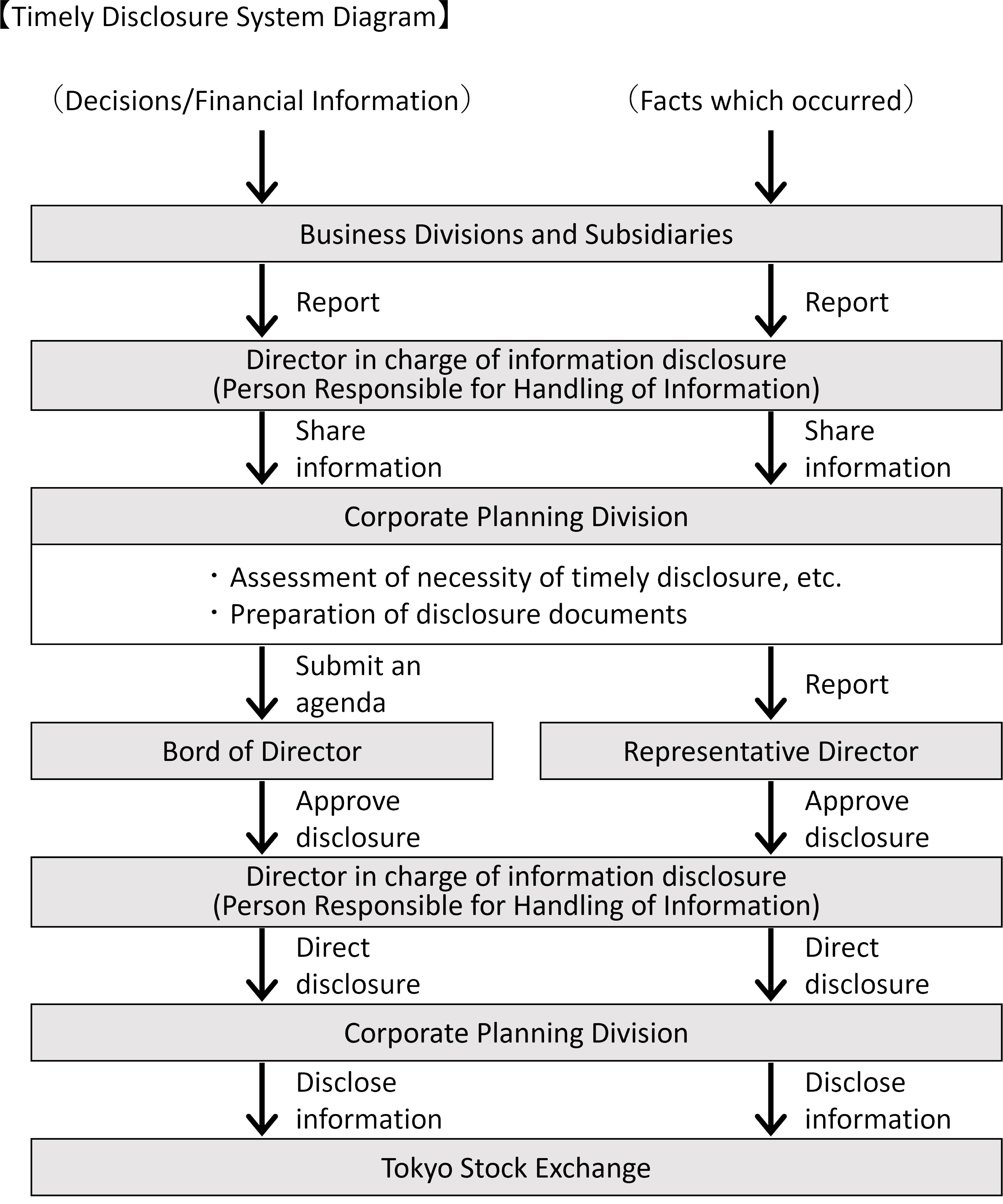

- (3)Disclosure regimes

- Director (CFO)receive reports on the details of matters at the Executive Committee of each division and subsidiary. The Corporate Planning Division confirms whether or not the matters are material in accordance with the timely disclosure rules, and not only examines the details of disclosures, but also prepares and confirms disclosure materials. At the Board of Directors meeting, decisions on matters and disclosure of material information, as well as voluntary information, are made by the Representative Directors. After the decisions are made, appropriate disclosure is promptly made through TDnet and corporate information websites.

- (4)Material Information Subject to Fair Disclosure Rules

- Material information defined under Article 27-36 of the Financial Instruments and Exchange Act (undisclosed material information about the operations, business, or assets of the listed company, etc. which has a material influence on investors’ investment decisions) may be communicated to certain business partners. In this case, the company will provide public disclosure in accordance with the Fair Disclosure Rules (Article 27-36 of the Financial Instruments and Exchange Act and Cabinet Office Orders on Disclosure of Material Information).

- (5)Statutory Information Disclosure

- Material information that is required to be disclosed by the Financial Instruments and Exchange Act will be disclosed in accordance with relevant laws and regulations.

3. Prevention of Insider Trading

We engage in the appropriate management of material information to prevent insider trading. To this end, we have established Insider Trading Regulations and strive to ensure all employees are familiar with these regulations.

4. Earnings Forecasts and Forward-Looking Information

The business earnings forecasts, strategies, policies, and goals disclosed by the company which are not historical facts are forward-looking forecasts determined by the company based on information available at the time they were prepared. These forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those projected.

5. Quiet Period

To prevent leaks of important information before publication and ensure the fairness of the disclosure of information, the company specifies thirty days until the release of financial results as a quiet period. We will answer no questions and make no remarks regarding the results of operations during this period, except in the case where there emerge future-related information and the material fact that would influence investment decisions considerably. However, in the event that facts applicable to timely disclosure occur during the relevant period, information will be disclosed as appropriate in accordance with the relevant rules.

6. Constructive dialogue with shareholders and investors

Our IR activities are overseen by the Director (CFO), and we strive to enhance communications with

our shareholders and investors.

In order to promote understanding of our corporate philosophy,

management strategy, and business conditions, in addition to holding meetings with shareholders and

individual IR, we are expanding our dissemination of information by holding financial results

briefings for analysts and institutional investors, holding briefings for individual shareholders

and investors, participating in small meetings sponsored by securities companies, and providing

topical coverage within convocation notices.

Feedback from the dialogue is provided by the Board

of Directors, the Executive Committee, various information-sharing meetings, and e-mails to internal

stakeholders. The feedback is used as a reference for examining issues that need improvement,

financial and non-financial indicators to be considered, and future strategies, in an effort to

further increase corporate value.

【Status of Dialogue with Shareholders and Investors】

Major Dialogue for the Fiscal Year Ended August 2024

| Activities | Frequency/Number of interviews |

Contents |

|---|---|---|

| Financial Results Presentation |

Every quarter 4 times in total |

Explanator:

Contents: |

| IR interviews | About 200 people |

Explanator:

Contents: |

| Briefings for individual shareholders and investors |

Once |

Explanator: Contents: |